Knowledge is power.

But many ecommerce businesses aren’t utilizing the knowledge from their data that they could be.

As Avinash Kaushik, digital marketing evangelist at Google and author of Web Analytics 2.0, says, “Most businesses are data rich, but information poor.”

In other words, they can’t see the wood for the trees.

With the ease of access to digital analytics today, this is a golden opportunity wasted.

So what are KPIs and which ones should you measure? In this article, you’ll learn all about six KPIs which are crucial to ecommerce businesses.

You can then use these KPIs to glean actionable insights from your data and inform impactful improvements to your business.

Let’s jump in.

Post Contents

What is a Key Performance Indicator (KPI)?

A key performance indicator – also known as “KPI” for short – is a metric that communicates how well an organization or individual performs against their principal objectives.

Think of them as signposts.

They tell you where you are on the map, and help you identify the route you need to take to achieve your business goals.

What Is the Difference Between Metrics and KPIs?

Simply put, KPIs are the metrics that matter.

“There are tons of metrics out there. Clicks. Percentage of new sales. Subscription revenue. But not all of them are KPIs,” says Klipfolio’s Jonathan Taylor. “KPIs are the most important metrics you have – the ones that really underscore what your key business goals are.”

Metrics are just a way of measuring things.

KPIs are a method of monitoring the most important aspects of your business in a way that helps you determine what actions to take.

What’s more, KPIs are often created from two or more metrics. For example, here are two metrics:

- Website traffic

- Number of sales

Now, the relationship between these two metrics is a popular KPI called “conversion rate.”

To work out the conversion rate, divide the number of sales by the number of website visitors, and then multiply it by 100 to get the percentage:

(50 Sales ÷ 1,000 Visitors) x 100 = 5% Conversion Rate

Many metrics are worth tracking even if you don’t consider them to be KPIs at the moment. Someday, those numbers may be incredibly useful.

Why Are KPIs so Important in Ecommerce?

Without KPIs, you’ll be forced to resort to gut reactions, personal preferences, or other unfounded hypotheses.

This is dangerous.

Good luck won’t last forever. Plus, one person’s intuition can’t be relied upon when a business grows.

The worst part? When something goes wrong, you won’t know why.

You might feel like things are going well, only to find your business is in dire straits. And because you’re not tracking a handful of essential KPIs, you’ll have no choice but to guess the reasons why.

Meanwhile, your more organized competitors will leave you in the dust.

If you don’t understand the outcomes of your strategies, you won’t be able to develop your business effectively and stride towards your goals.

As Peter Drucker famously said, “What gets measured gets improved.”

KPIs provide objectivity.

With them, you’ll have a clear, accurate understanding of your business so you can make informed, strategic decisions.

But KPIs aren’t valuable on their own.

As Andrew Lang put it, “Most people use statistics the way a drunkard uses a lamppost – more for support than illumination.”

The true power of KPIs lies in your ability to interpret the data and draw out actionable insights which can help you to improve your business.

With them, you can achieve long-term success by consistently taking the optimum actions.

Sure, tracking and interpreting KPIs can be difficult and time-consuming.

But as Arthur C. Nielsen, a pioneer of modern marketing research, said: “The price of light is less than the cost of darkness.”

What Makes an Effective KPI?

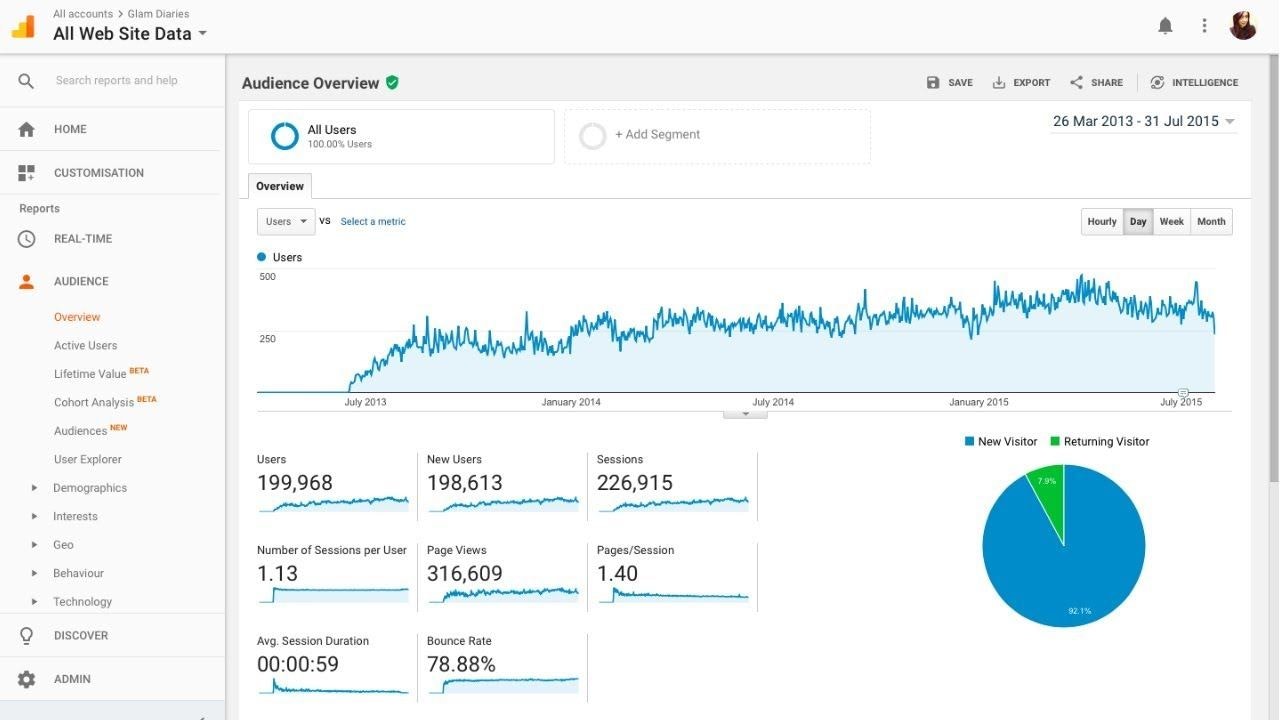

Today, online businesses are able to use tools like Google Analytics to track a lot of different metrics.

And I mean, a lot.

(Source)

However, as Albert Einstein said, “Not everything that can be counted counts, and not everything that counts can be counted.”

So how can you identify what to count?

To provide useful, actionable insights into a company’s performance, KPIs must possess four characteristics:

- Impact the bottom line: KPIs should relate to the bottom-line and be crucial to achieving your goal.

- Can be measured accurately: The best KPIs are simple and easily calculated. You need to accurately track the data needed to create an indicator. Effective KPIs are well-defined and quantifiable.

- Timely: To be useful, you need access to real-time KPI results so you can implement improvements. Old data is only useful when combined with real-time data to track trends.

- Actionable: Most importantly, KPIs need to help you understand the improvements you need to make.

When trying to identify KPIs, it also helps to work backward.

“Results ultimately stem from the right activities,” says Hubspot director of business development, Justin Hiatt.

“Working backward from the end goal like revenue to the front end of the sales process will help the salesperson understand the necessary activity to achieve their goal.”

Okay, let’s get specific.

6 Essential KPIs to Track for Your Ecommerce Store

Now that you have a clear understanding of what KPIs are and how you can use them to continually improve your business, let’s dig into six crucial KPIs for ecommerce businesses:

- Shopping cart abandonment rate

- Conversion rate

- Cost of customer acquisition

- Customer lifetime value

- Average order value

- Gross profit margin

Fair warning: There will be math involved.

Maybe you don’t like math… unless there’s money involved. Well, this math has the potential to make you a lot more money.

These KPIs can provide extremely valuable insights into your business’s inner workings. They will help you to identify the potential disasters to avoid, and the best opportunities to capitalize on.

Sound good?

1. Shopping Cart Abandonment Rate

Cart abandonment is a term used in ecommerce to refer to visitors placing items in their shopping cart, but then leaving the site without completing the purchase.

This sucks.

Think of all the time and money you put in to get customers to the check out process: You crafted an offer, captured their attention, nurtured the relationship, and got them all the way to the finish line… only to fall at the last hurdle.

The worst part is that it’s a very common occurrence.

In fact, according to the Baymard Institute, the average shopping cart abandonment rate for eCommerce sites is nearly 70 percent.

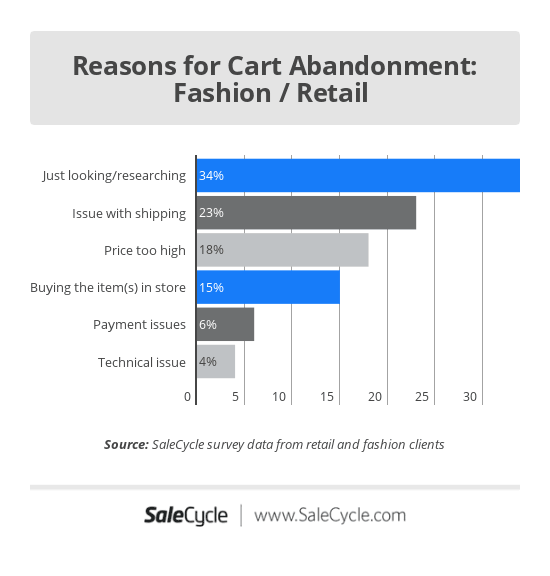

So why do people abandon their carts?

Well, the reasons include unexpected shipping costs, website errors, a complex check out process, a declined card, and visitors simply not being ready to buy.

Thankfully, it’s not all doom and gloom.

Although online retailers could lose as much as $4 trillion to cart abandonment each year, BI Intelligence suggests that savvy retailers should be able to recover about 63 percent of that lost revenue.

This is why you should carefully track and measure your cart abandonment rate.

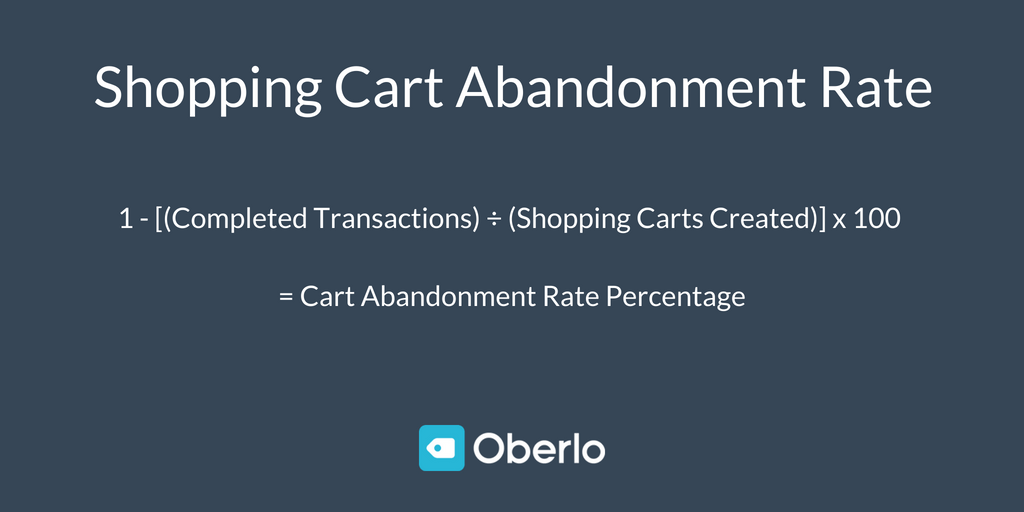

The shopping cart abandonment rate is calculated by dividing the number of completed purchases by the number of shopping carts created. To turn the rate into a percentage subtract your number from one, and then multiply it by one hundred:

1 – [(No. of Completed Transactions) ÷ (No. of Shopping Carts Created)] x 100 = Cart Abandonment Rate Percentage

For example, if you have 50 completed purchases from 250 shopping carts created, the shopping cart abandonment rate would be 80 percent:

1 – (50 ÷ 250) x 100 = 80%

Find out how to improve your cart abandonment rate by reading our guide: Help! I Have Lots of ‘Add to Carts’ but No Sales!

2. Conversion Rate

How effective are your landing pages and calls-to-action? Do they just look pretty, or are they doing their job and encouraging more people to buy your products?

Your conversion rate will reveal the truth.

Conversion rate refers to the percentage of your visitors who take an action on your website. This action can be anything, such as signing up for an email newsletter or making a purchase.

Your conversion rate tells you how effective your webpage is at encouraging visitors to take an action.

For example, if your landing page is receiving a lot of traffic, but has a very low conversion rate, you’ll need to test ways to improve the page to encourage more conversions.

What’s a good conversion rate?

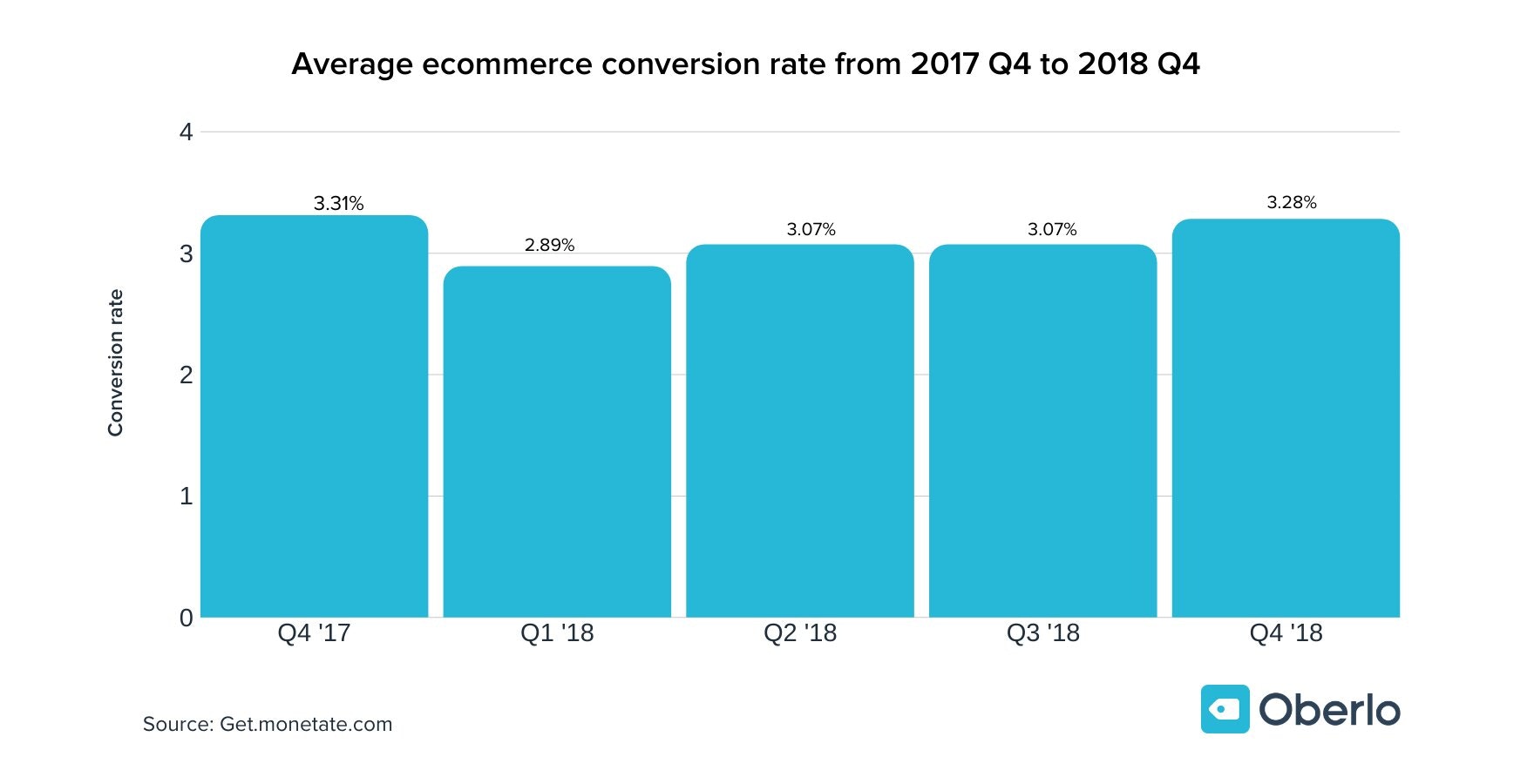

The average conversion rate for online shoppers worldwide is between 2.89 and 3.31 percent.

The best part? Small tweaks can result in big gains.

Here’s what I mean: Say that you get 20,000 visits to your website and that 2% of visitors convert and buy a $100 product.

In this example, you’ll make $40,000.

Now, if you increase your landing page conversion rate by just 0.5%, you’ll make an additional $10,000!

Still, the real power of conversion rates is unleashed when you track and improve each step of your marketing funnel.

This way, the effect is compounded.

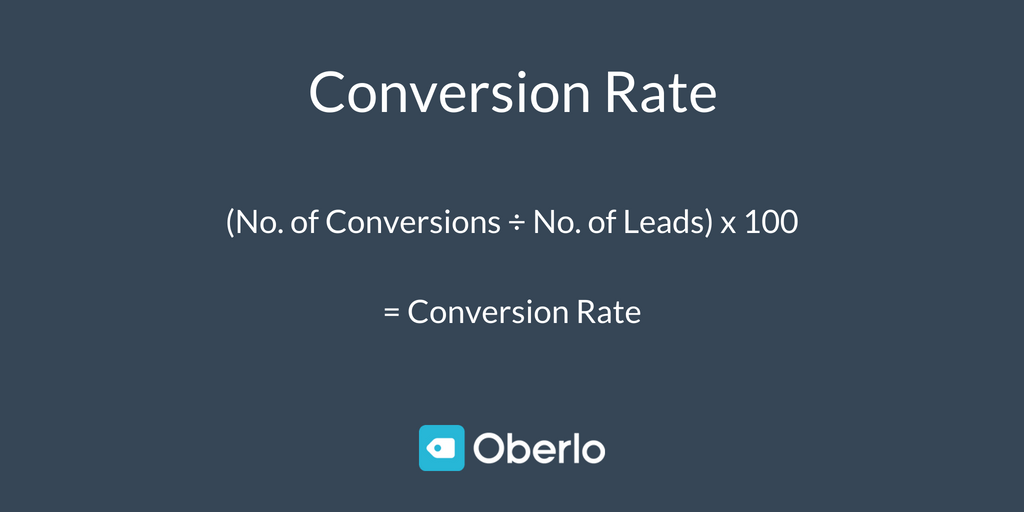

To calculate your conversion rate, divide the number of conversions – whatever conversion you’re looking for, whether it’s newsletter signups, purchases, etc. – by the number of visitors to your store, and then multiply it by 100 to get the percentage:

(No. of Conversions ÷ No. of Leads) x 100 = Conversion Rate

For example, if you make 50 sales from 1,000 website visitors, your conversion rate will be 5%.

(50 Sales ÷ 1,000 Visitors) x 100 = 5% Conversion Rate

To learn more about conversion rates, read our guide: How to Get More Sales With Ecommerce Conversion Optimization.

3. Customer Acquisition Cost (CAC)

Customer acquisition cost – also referred to as CAC – is how much money it takes to “buy” a customer.

For example, let’s say that in one month you spent $1,000 on sales and marketing and closed 25 new customers. Each customer would have cost you $40 to acquire.

Knowing your CAC is vital.

If your average order value is $4,000 for industrial machinery, $100 dollars to acquire a new customer is a dream! But if you’re selling backpacks for $80, you’ll need to find a way to drastically lower your CAC – fast.

But that’s not all.

Understanding your CAC also allows you to plan how many customers you want to acquire in a certain time period, and then allocate your marketing budget appropriately.

What’s more, when you understand the variables and metrics underpinning your customer acquisition cost, you can take steps to reduce it.

Most importantly, you need to know what it is to keep it in check.

Sure, you can make more sales by throwing more money into marketing. But if your CAC increases too, making more sales could mean that profits actually decrease.

Bottom line: If you don’t know how much it costs to transform a prospect into a paying customer, your business may collapse, leaving you clueless as to why.

To calculate your customer acquisition cost, simply divide the total amount of money spent on marketing and sales by the total number of customers those activities delivered.

Amount of Money Spent to Acquire Customers ÷ No. of Customers Acquired = Customer Acquisition Cost

4. Average Order Value (AOV)

Average order value – also know as AOV – is an ecommerce metric that refers to the average amount of money spent by customers per order.

Increasing your AOV can be one of the easiest ways to boost your revenue.

Plus, by receiving more money from each customer, you can absorb higher customer acquisition costs while still maintaining profits.

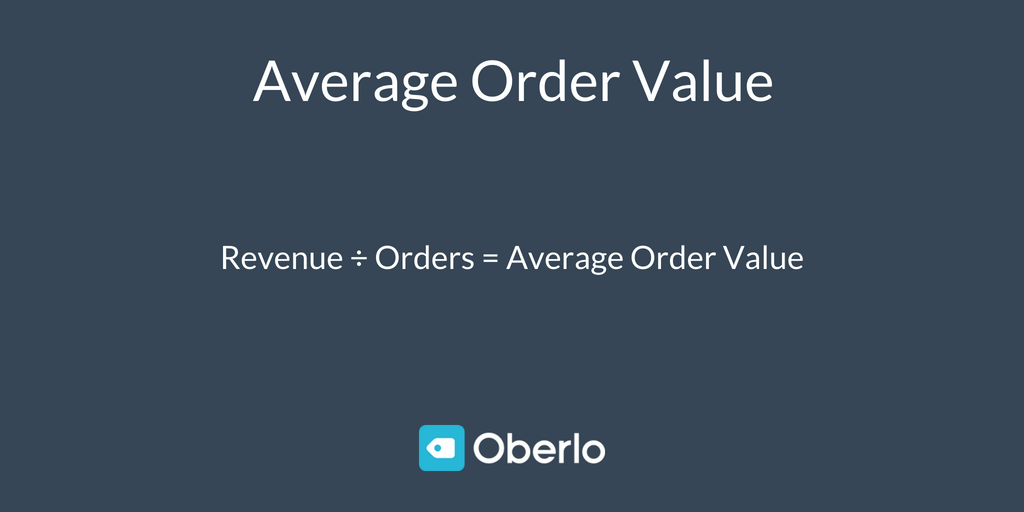

To calculate your average order value in a given time frame, take your total revenue and divide it by the total number of orders:

Total Revenue ÷ Total No. of Orders = Average Order Value

For example, if you made $10,000 from 120 sales in one month, then your AOV would be $83.33.

To find out how to boost your average order value, read our guide: 4 Easy Ways to Massively Boost Sales with Upselling and Cross-Selling.

5. Customer Lifetime Value (CLV)

How much is a customer worth to your business?

Customer lifetime value – often referred to as CLV, CLTV, or LTV – is the average amount of net profit that each customer is predicted to contribute to a business over the entire length of the relationship.

Determining how much a customer is worth to your business is a daunting, but essential task.

It will help you to understand your return on investment (ROI), and it’s extremely useful when strategizing future goals.

This KPI also helps you understand how well your business retains customers. This is crucial when you consider that:

- A 5% increase in customer retention can increase company profits by 25-95%.

- Gaining new customers is anywhere from 5 to 25 times more expensive than retaining current ones.

- Repeat customers spend 67% more than new customers.

(Source)

It’s important to note that LTV is rarely exact.

However, what it lacks in preciseness, it more than makes up for with its sweeping bird’s-eye view.

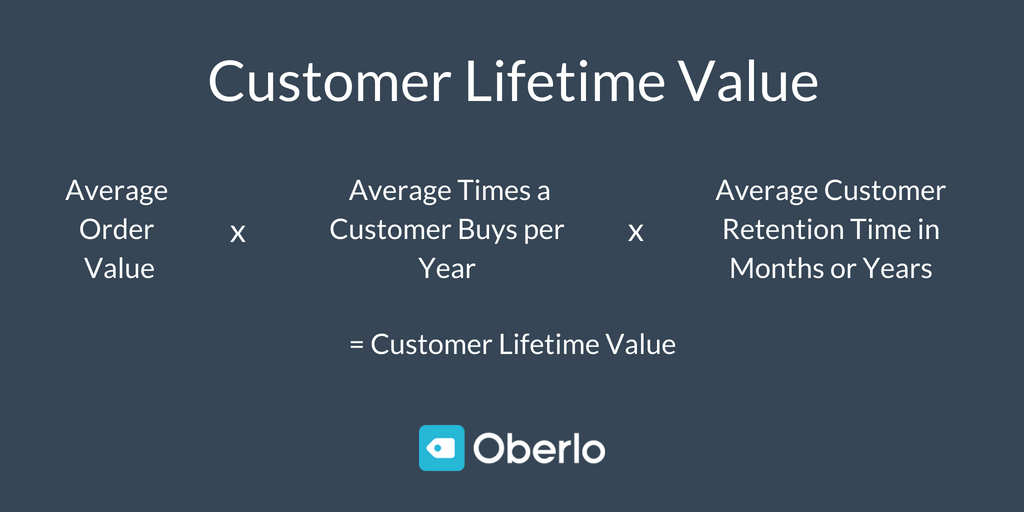

This KPI is a little more complex to figure out. Before you can begin, you need to have calculated three other averages from your metrics:

- Average order value

- Number of times a customer buys per year on average

- Average customer retention time in months or years

Then, you can calculate the lifetime value of your customers by multiplying your averages:

(Average order value) x (Average number of times a customer buys per year) x (Average customer retention time in months or years) = Customer Lifetime Value

To learn more about this crucial KPI, check out our in-depth guide: Customer Lifetime Value for Ecommerce Stores.

6. Gross Profit Margin

When running a business there’s so much to consider: Product creation, marketing, building a team, customer service… the list goes on and on.

But there’s one thing you should never lose sight of: Profit.

A business isn’t a business if it doesn’t ultimately make a profit. Remember: The money you earn from sales is revenue. We still need to subtract costs to be left (hopefully) with a profit.

Your gross profit margin sums up how much money you actually make by presenting the difference between your revenue and profit as a percentage.

For example, say that it costs you $100 to buy bike parts. Then, you build a custom bike and sell it for $250. In this case, your profit margin would be $150 or 60%.

Understanding your gross profit margin will help you to gauge the health of your business.

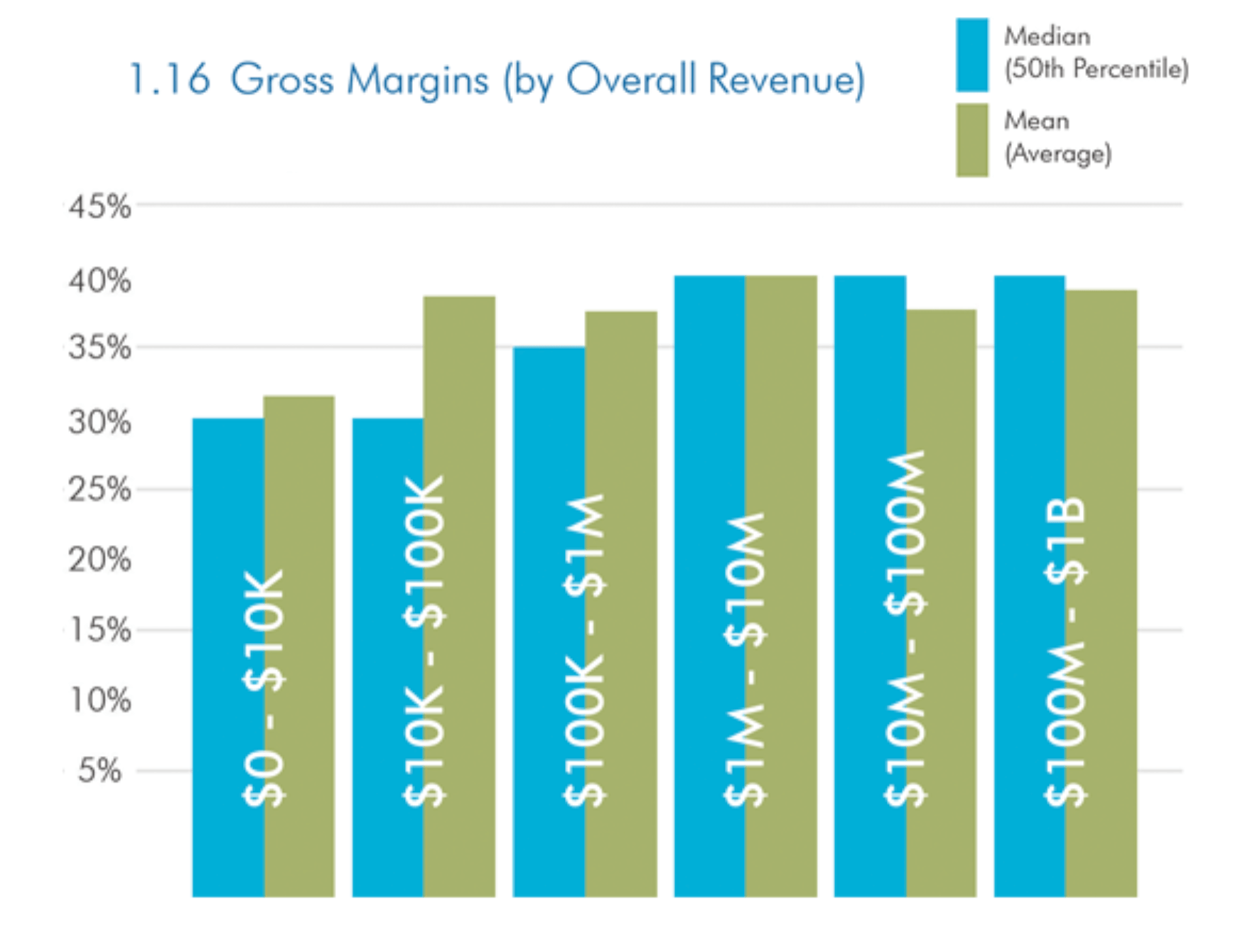

So what is a healthy gross profit margin for an ecommerce business?

Well, in a MarketingSherpa eCommerce Benchmark Study, the average gross margin for companies earning up to $10K was 30%.

Now, a high gross margin is a wondrous thing.

If you have a high gross profit margin, you’ll be left with plenty of money to reinvest into growing your business.

However, a poor gross profit margin will create cash flow problems and eventually stunt business growth.

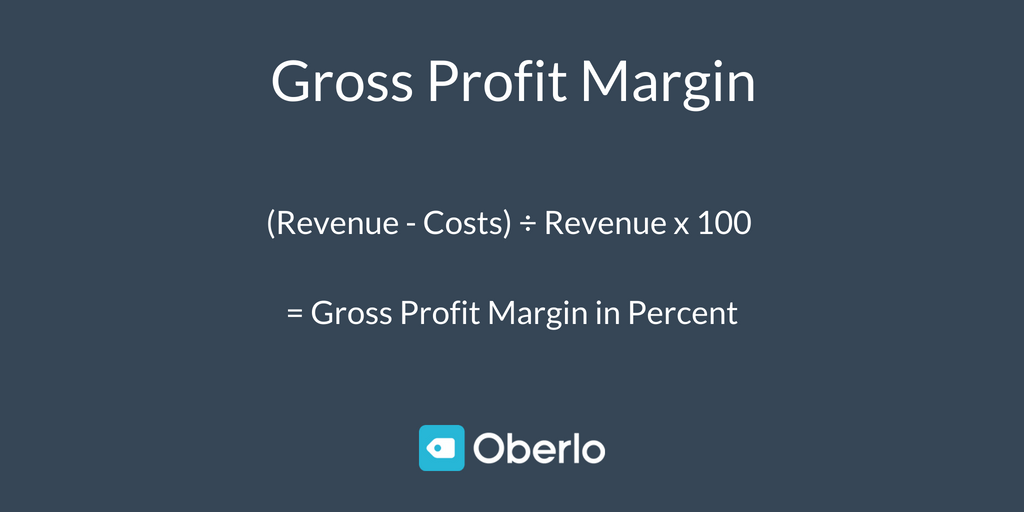

To calculate the gross profit margin you need to know two things:

- Total revenue – how much money you’ve earned in sales.

- Cost of goods sold (COGS) – your total business costs, including manufacturing, marketing, operations, employee salaries, etc.

First, let’s calculate your profit. Take your total revenue for a given period and subtract your cost of goods sold:

Revenue – Cost = Profit

Then, to calculate the gross profit margin percentage, divide your profit by your total revenue and then multiply it by 100.

(Revenue – Costs) ÷ Revenue x 100 = Gross Profit Margin in Percent

For example, if you made $20,000 in sales with costs of $12,000, your profit margin would be $8,000. Then, divide $8,000 by $20,000, and multiply it by 100 to reveal a gross profit margin of 40%.

($20,000 – $12,000) ÷ $20.000 = 0.4 x 100 = 40%

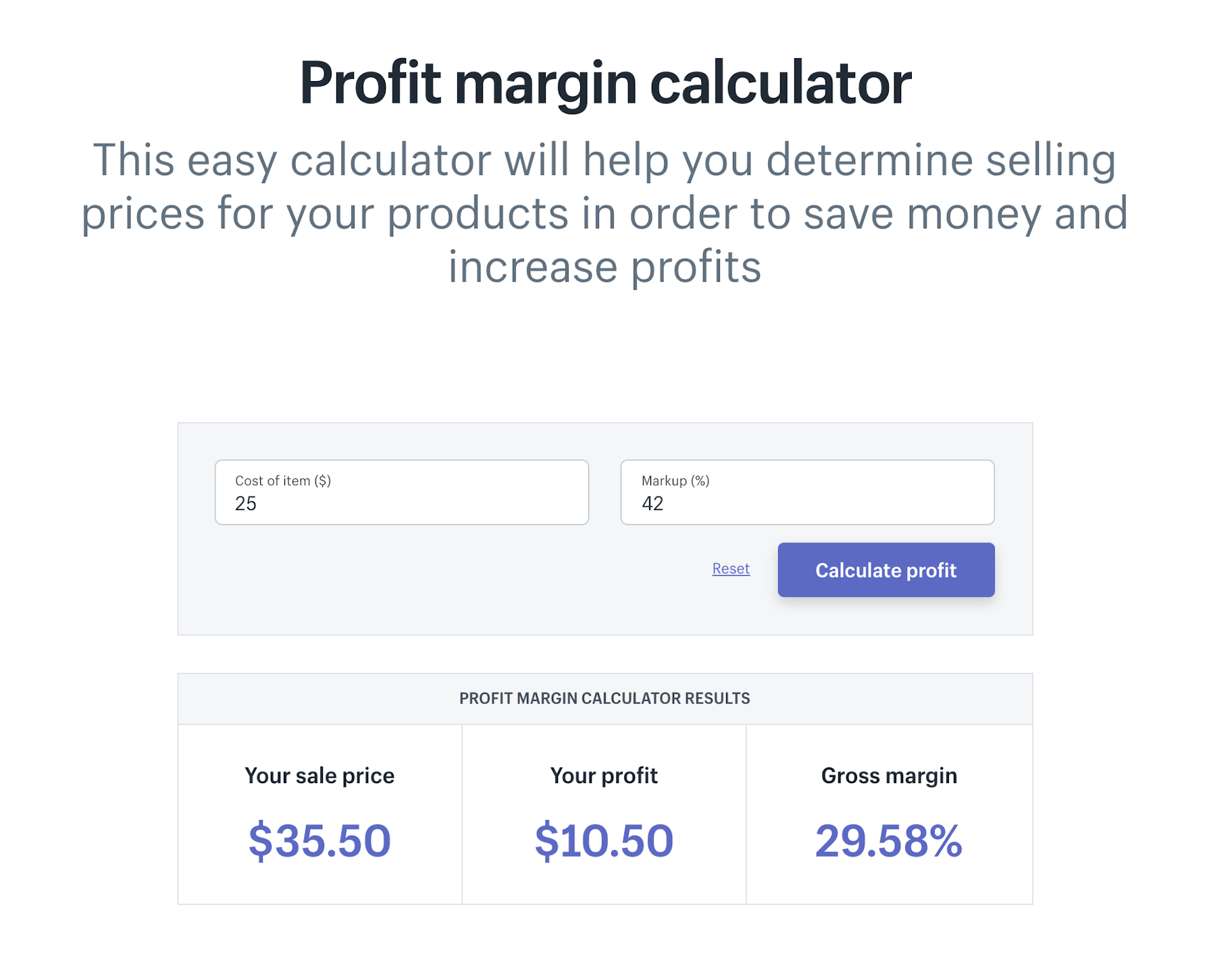

Feel free to use Shopify's profit margin calculator to help!

To learn more about margins and pricing your products, read our in-depth guide: Pricing Strategy for Ecommerce – Is Your Price Right?

Summary

KPIs can feel confusing, overwhelming, and frustratingly difficult to apply.

But the time and effort that you put into tracking and understanding them will undoubtedly pay off.

Learning about the relationships between the core components of your business will enable you to make informed, objective decisions. And these decisions can have an incredible impact on your business’s bottom-line.

Remember, knowledge is power.

So work to understand your business’s data, and harness the actionable insights that will propel you forward.

Which KPI are you most keen to come to grips with? Let us know in the comments below!